You are trading in the midst of a boom in the economy: everyone is optimistic about everything, the stock market is on fire, and sales are excellent. Quarter after quarter, you make money, and your investors get generous returns. But then, almost without warning, a recession occurs. Your sales forecast suddenly looks awful. So, in a down economy, how can you keep your business afloat?

We’ll show you some ways to safeguard your business during a recession in this blog post. The advantages of starting a business during a downturn will then be discussed.

1. Cutting company’s spendings

Cutting costs involves lowering your burn rate, which can also extend your cash runway. You’ll have more freedom with this strategy because no one will tell you what to do or how to use the money you save.

You can look at your burn rate from both a revenue perspective and a margin perspective to know how much real time your business has to remain solvent. Once you’ve calculated your burn rate, consider reducing or cutting costs in these areas:

Full-time employee (FTE) numbers and benefits

Layoffs may seem enticing, but this cost-cutting method is rougher because you’re affecting people’s lives and families. Consider alternatives first, like cutting back marketing expenses and SaaS spending or enforcing stricter expense policies across offices worldwide.

Customer acquisition costs (CAC)

Take a good look at your CAC, because you’re probably spending a lot of money for very little ROI. For example, if you’re bleeding money on advertisements that aren’t bringing in high-quality leads, scale this back and rethink your strategy.

Global expenses.

You may be using different suppliers and vendors for the same services in your satellite offices around the world. Cut what you don’t need and negotiate deals with the most cost-effective vendors. Invest in global expense management software that can track your expenses worldwide with one tool.

2. Going with layoffs

A layoff, also known as a termination of workers’ employment, is a temporary suspension, but more often than not, a permanent termination of employees from their jobs in the organization.

Establish an environment that helps workers. You can know the company’s health by observing the work environment. When employees work in positive environments, they are happier, more committed, and more motivated, contributing to the profitability of the company.

Upgrading your workforce. It is difficult and time-consuming, but the reward is well worth it. So, you can keep your employees’ skills fresh with an upgraded workforce.

Collect feedback from employees. It is a good way to get an inside look at how well your business is performing. You can inspire trust and respect in your employees and avoid losing money because of poor administration. Besides, when you gather employee feedback, you display your leadership skills and motivate your workers.

3. Managing processes

Clearly distinguish core processes

Knowledge of core processes has three key benefits:

- Streamlined and clearer core and support processes by separating support processes

- Quality improvement as employees focus on and optimize core competencies

- Potential for savings in support processes – feasible through more efficient organization of the process

Each company must focus on developing these core processes so that it can fully exploit its competitive skills in process performance.

Making your product stand out

Do you think your product is unique? Statistically speaking, it probably isn’t, but that doesn’t matter when it comes to making your product stand out. Some of the most successful products on the market are hardly all that new or original. It’s important to be innovative and flexible, but there’s no need to reinvent the wheel to succeed.

Establishing new business lines

Every small business needs to be able to adapt to change, especially in times of growth or uneven cash flow. When you need ready access to cash and flexible terms for repaying borrowed funds, an unsecured line of credit can often be an ideal solution.

Like a small business loan, an unsecured line of credit provides a business with access to money that can be used to address any business expense that arises. Unlike a small business loan, however, there’s no lump-sum disbursement made at account opening that requires a subsequent monthly payment.

4. Fundraising

Fundraising was never going to be easy. Convince investors you have a great idea by demonstrating industry knowledge, solving a problem, and reaching your target demographic.

Startup fundraising in a market downturn comes down to quality and quantity.

When the stock market is going up, people can’t help feeling optimistic, investors included. They’re more willing to fund early ventures and take more considerable risks. They are more likely to skip due diligence and just trust their gut. In other words, it’s much easier to acquire funding in a bull market, and it isn’t just because of available capital.

It’s strange that so much of our economy relies on nothing more than faith, but there it is.

In a bear market, there are fewer assurances and less confidence. As we’ve mentioned before, investors have this reputation as risk-takers, but that’s simply the nature of investing. In reality, they try to mitigate risk as much as possible. It’s rare for venture capitalists or angel investors to give money to anyone who doesn’t have their ducks in a row.

When startups raise money in a market downturn, quality becomes much more important than quantity. Early-stage startups are less likely to acquire funding during a downturn or recession because they’re risky. Your job becomes demonstrating that you are not a risk. Focus on traction and monetization metrics. Show monthly recurring revenue, annual recurring revenue, monthly active users, and daily active users.

Stay the course

You may be thinking your timing couldn’t be worse. The competition in a sector flooded with capital just a year ago has suddenly become very stiff. But you have to have faith in yourself and your startup. If you don’t believe that you could be one of the few companies to prosper during the downturn, you can bet your bottom dollar (pun intended) that no investor will believe it either.

We’ve talked with founders and experts several times about the qualities that are necessary for a startup founder. We’ve heard about drive, focus, flexibility, and the ability to work well with others. The most important quality, however, is determination.

You don’t have to go through startup fundraising alone

Putting your best foot forward in a market downturn is especially important. You only get one chance to pitch to investors, VCs, competitions, etc., and it never hurts to know an experienced team of founders, advisors, and startup professionals have your back.

Working with a startup studio like Beeso Studio can help determine if your idea is viable and improve your chances of acquiring funding. If your company is compatible with our portfolio, we’ll work to help your company grow.

5. Preserving capital

Track cash burnt

Cash burn is most often calculated on a monthly basis. In some situations, it can be expressed as a weekly or daily rate. It is important that business owners pay attention to their company’s burn rate. Having too high or too low of a rate can indicate problems with a company’s financial health.

to

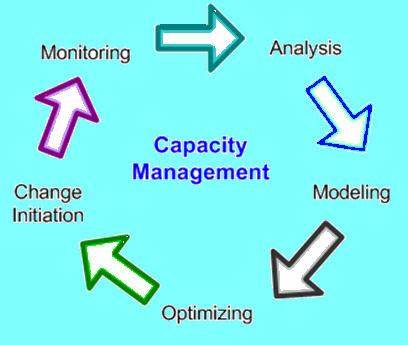

Increase operational capacity

Businesses need to know and manage constraints, especially when they are growing. In many ways, constraints are the flipside of capacity where business operations are concerned, because increasing operational capacity will generally decrease constraints. Yet very few business owners and leaders think enough about operational capacity—until it gets them into trouble.

Maintain operating expenses in cash

Operating expenses are essential for analyzing a company’s operational performance. It is therefore important for both internal and external analysts to identify a company’s opex, understand its primary cost drivers, and assess management efficiency.

Conclusion

If you plan ahead and adopt the right strategies during a recession, your company stands a much better chance of surviving an economic downturn. Startups actually do pretty well during recessions, so if you’ve considered starting your own company, now might be the ideal time to do so.